HTL Freight Economic Update

Table of Contents

Freight Demand Continues To Weaken As Economy Flirts With Recession

Conditions in the freight markets softened, as high inflation, aggressive monetary policy, geopolitical turmoil and continued supply chain disruptions have sapped much of the momentum from the broader economy. The odds of a recession have increased significantly over the past few months, which would likely have a significant impact on several key drivers of freight demand.

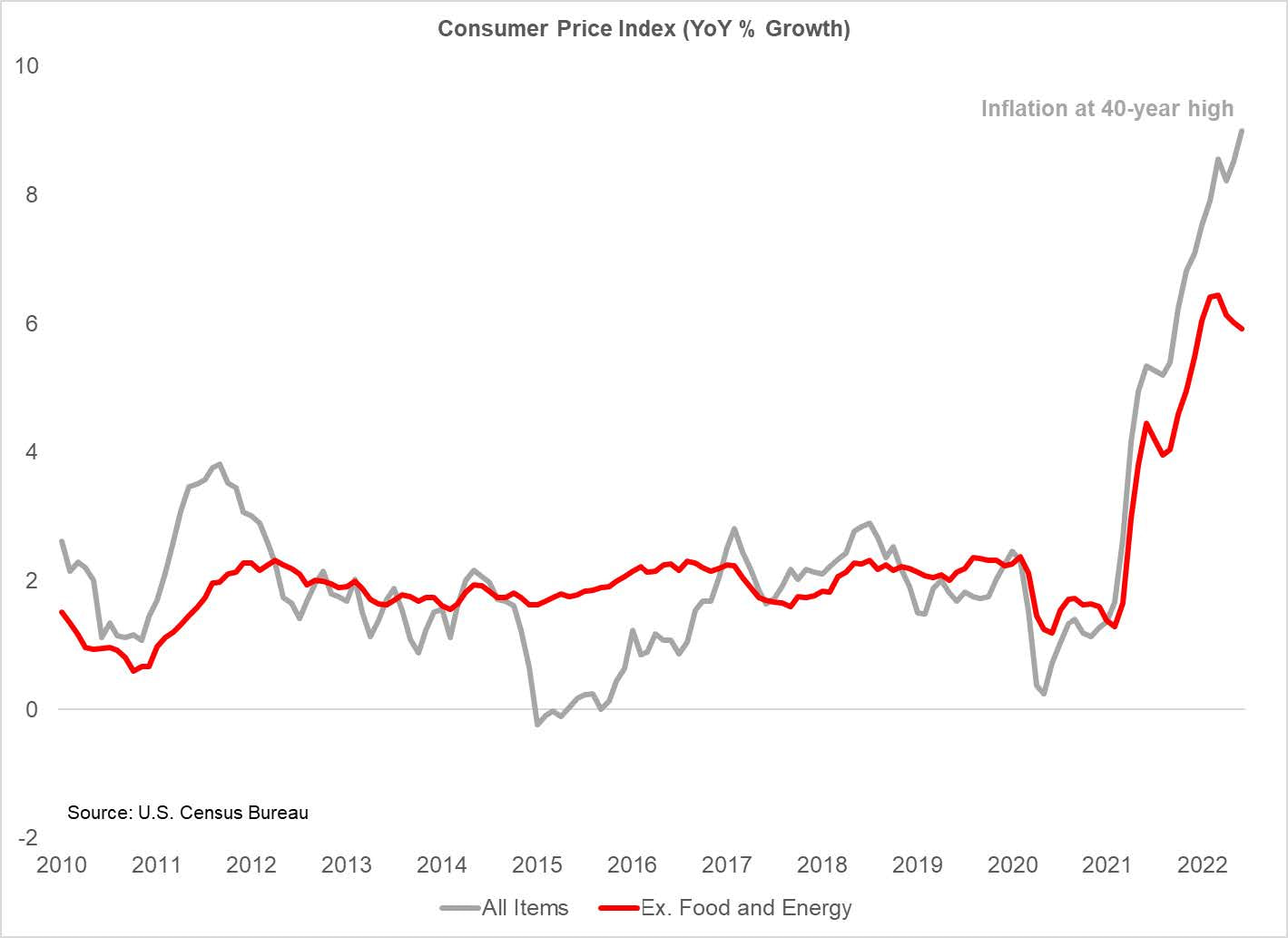

Inflation continues to be one of the key headwinds for the U.S. economy midway through the year, as year-over-year growth in the Consumer Price Index hit a 40-year high of 9.1% in June. Core price increases, excluding food and energy, have actually moderated over the past couple of months (Figure 1) but the continued Russia-Ukraine conflict has put upward pressure on oil and food prices and kept overall inflation elevated.

High Inflation Continues To Weigh On Economic Performance

The stubborn pace of inflation has sapped much of the momentum from U.S. consumers, who have had to ramp up their credit usage in order to accommodate higher prices. Adjusted for inflation, consumer spending slipped in May for the first time this year and are now just 2.1% higher than this point last year. From a freight perspective, conditions are even weaker as spending on goods turned negative year-over-year in the 2nd quarter.

The Federal Reserve has become increasing aggressive in its efforts to curb inflation, raising its core federal funds rate by 75 basis points in July. This comes on the heels of a 75 basis point hike in June and a 50 basis point increase in May. As a result, borrowing rates for consumers, like credit card and auto loan rates, have jumped over the past few months. This has negative implications for consumer spending going forward, particularly for durable goods like motor vehicles and appliances which are more likely to be financed through credit.

The housing market provides the clearest picture of the impact of higher rates on overall activity. Mortgage rates surged to the highest point since the end of the Global Financial Crisis in June, and remain above 5.5% in mid-July. This has major implications for housing affordability in the economy, as buyers now face significantly higher rates when purchasing a home. As a result, the number of homes purchased has tumbled in recent months. Existing home sales fell 3.4% in May from April’s levels and are now nearly 8% lower than at this point last year. Builders have taken notice of the weakened demand and have begun to slow the pace of new construction in the housing market. New builds in the single family category fell for the fourth consecutive month in June and are now 15.8% lower than at this point in 2021.

Freight Demand Is Resetting While Capacity Remains Elevated

The weakness in the housing sector has important implications for freight demand. Lumber and construction materials are a key driver for flatbed demand, and the deterioration in home builders’ sentiment and housing construction likely means normalized demand for type of freight going forward. Home sales typically drives demand for purchases of durable goods like appliances and furniture, which already have to contend with the impact of higher interest rates.

The number of headwinds suggests that the freight environment is weakening considerably. Nearly every variable that impacts freight demand, including consumer spending, import demand, domestic manufacturing, and housing has cooled off over the last few months and is likely to soften further over the next quarter.

It is worth noting, however, that most of these declines are coming off of outsized gains from 2021. Even with recent declines, most of the components of freight demand remain well above prepandemic levels. So as the overall economy teeters on the brink of recession, the freight economy appears to be resetting back to normal levels in 2022 after peaking in 2021.

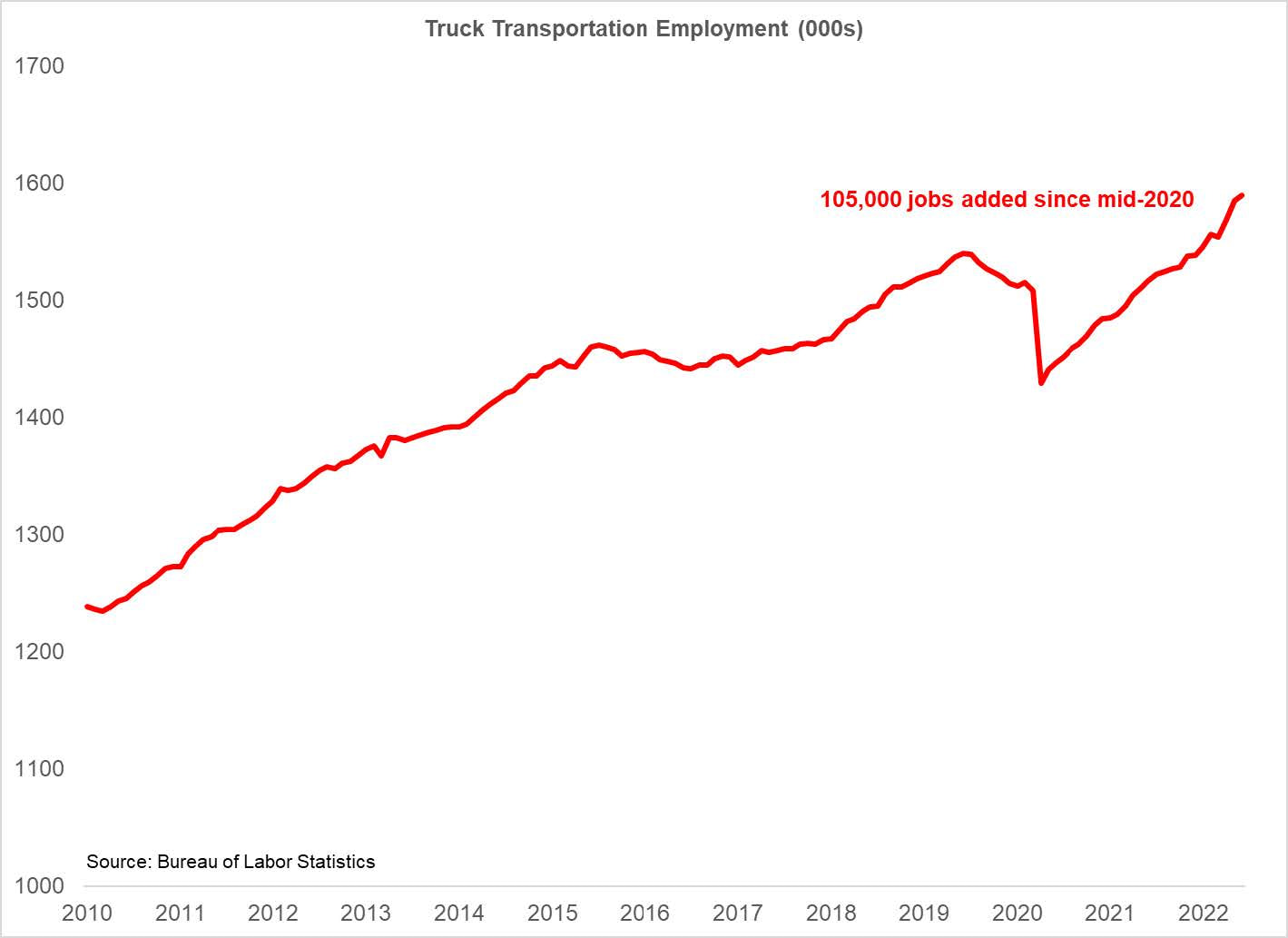

The challenge is that this reset comes at a time of expanded capacity in the industry. Carriers continued to hire in the 2nd quarter, as jobs in trucking increased in each of the last three months (Figure 2). This brings the total number of jobs added in the industry up to 72,700 over the last year and nearly 105,000 over the past 18 months.

Job growth is slowing however, and data on FMCA authority grants and revocations suggests that smaller and independent carriers are beginning to exit the industry. In addition, Class 8 orders have cooled considerably during the 2nd quarter and are now down 36% from this point last year.

Still, at this point the industry is facing elevated capacity relative to pre-COVID levels while demand continues to normalize. As a result, carriers have begun to lose much of the pricing power that they enjoyed since the initial months of the COVID-19 pandemic.

Declines In Spot Rates Have Spilled Over Into Contract Rates

Spot rates for van and reefer load have fallen steadily amidst this backdrop since the start of the year. Flatbed spot rates, which actually improved at the start of the year, have stalled in recent weeks as the number of loads has declined. The softness in the spot market appears to be taking hold in contract rates as well. Producer price index data from the trucking industry, which tracks closely with contract rates, fell for the first time in two years in June from May’s levels. With the decline, rates are still 24.6% higher than at this point last year, but given the broader macro environment, June’s results could represent and inflection point for the sector.

Looking forward, if rates continue to deteriorate in upcoming quarters, it poses a significant risk for carriers. Much of the expansion in hiring from established carriers and new entry into the industry has been driven by the promise of high rates in the sector. To the extent that these rate gains begin to ease, the industry could soon find itself looking to reduce capacity. In the past, prolonged periods of rate declines have led to unemployment, trucking bankruptcies, and consolidation in the industry. As demand heads back to prepandemic levels, capacity and rates may similarly reset in upcoming quarters.